Recently,

banks are in a period that they earn money in servicing beyond selling money.

The prestige is get as they offer their services to the masses. Like other

services, banking services are also intangible. Banking services are about the

money in different types and attributes like lending, depositing and

transferring procedures. These intangible services are shaped in contracts. The

structure of banking services affects the success of institution in long term.

Besides the basic attributes like speed, security and ease in banking services,

the rights like consultancy for services to be compounded are also preferred.

Price:

The price

which is an important component of marketing mix is named differently in the

base of transaction exchange that it takes place. Banks have to estimate the

prices of their services offered. By performing this, they keep their relations

with extant customers and take new ones. The prices in banking have names like

interest, commission and expenses. Price is the sole element of marketing

variables that create earnings, while others cause expenditure.

While

marketing mix elements other than price affect sales volume, price affect both

profit and sales volume directly.

Banks should

be very careful in determining their prices and price policies. Because

mistakes in pricing cause customers’ shift toward the rivals offering likewise

services.

Traditionally,

banks use three methods called “cost-plus”, “transaction volume base” and

“challenging leader” in pricing of their services.

Distribution:

The

complexity of banking services is resulted from different kinds of them. The

most important feature of banking is the persuasion of customers benefiting

from services.

Most banks’

services are complex in attribute and when this feature joins the intangibility

characteristics, offerings take also mental intangibility in addition to

physical intangibility. On the other hand, value of service and benefits taken

from it mostly depend on knowledge, capability and participation of customers

besides features of offerings. This is resulted from the fact that production

and consumption have non separable characteristics in those services.

Most authors

argue that those features of banking services make personal interaction between

customer and bank obligatory and the direct distribution is the sole

alternative. Due to this reason, like preceding applications in recent years,

branch offices use traditional method in distribution of banking services.

Promotion:

One of the

most important elements of marketing mix of services is promotion which is

consist of personal selling, advertising, public relations, and selling

promotional tools.

Personal Selling:

Due to the

characteristics of banking services, personal selling is the way that most

banks prefer in expanding selling and use of them.

Personal

selling occurs in two ways. First occurs in a way that customer and banker

perform interaction face to face at branch office. In this case, whole

personnel, bank employees, chief and office manager, takes part in selling.

Second occurs in a way that customer representatives go to customers’ place.

Customer representatives are specialist in banks’ services to be offered and

they shape the relationship between bank and customer.

Advertising:

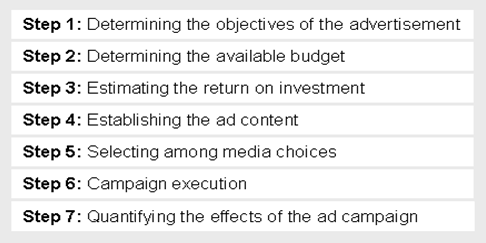

Banks have

too many goals which they want to achieve. Those goals are for accomplishing

the objectives as follows in a way that banks develop advertising campaigns and

use media.

1. Conceive

customers to examine all kinds of services that banks offer

2. Increase

use of services

3. Create

well fit image about banks and services

4. Change

customers’ attitudes

5. Introduce

services of banks

6. Support

personal selling

7. Emphasize

well service

Advertising

media and channels that banks prefer are newspaper, magazine, radio, direct

posting and outdoor ads and TV commercials. In the selection of media, target

market should be determined and the media that reach this target easily and

cheaply must be preferred.

Banks should

care about following criteria for selection of media.

1. Which

media the target market prefer

2.

Characteristics of service

3. Content of

message

4. Cost

5. Situation

of rivals

Ads should be

mostly educative, image making and provide the information as follows:

1. Activities

of banks, results, programs, new services

2. Situation

of market, government decisions, future developments

3. The

opportunities offered for industry branches whose development meets national

benefits.

Public Relations:

Public

relations in banking should provide;

1.

Establishing most effective communication system

2. Creating

sympathy about relationship between bank and customer

3. Giving

broadest information about activities of bank.

It is

observed that the banks in Turkey perform their own publications, magazine and

sponsoring activities.

Selling Promotional Tools:

Another element of the

promotion mixes of banks is improvement of selling. Mostly used selling

improvement tools are layout at selling point, rewarding personnel, seminaries,

special gifts, premiums, contests.

You can subscribe by e-mail to receive news updates and breaking stories.

You can subscribe by e-mail to receive news updates and breaking stories.