Explain the different steps in advertising for bank or financial services institutions

Posted by Ripon Abu Hasnat on Monday, June 9, 2014 | 0 comments

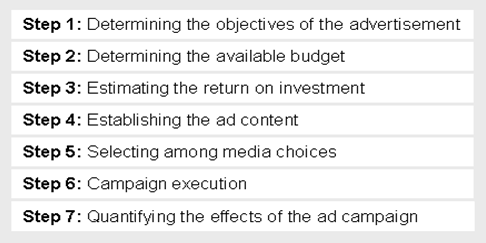

Several steps

are essential for successful execution of advertising campaigns in financial

services. These steps are-

Determining the Objectives of Advertising:

The first

step is to determine the objectives of the advertising campaign, reflecting the

overall marketing strategy of the company.

For example,

the objective of an advertising campaign might be to generate new policies for

an insurance product or to increase the level of consumer awareness of the

brand or the company. Recognizing and identifying the exact objective of an ad

campaign is critical to accurate assessment of its merits and potential.

Examples of popular advertising objectives in financial services are target

levels for customer inquiries, new policies signed, and advertising recall.

(2) Determining the available Budget

The next step

in the advertising process is to determine the budget required to carry out the

ad campaign. Often, the required budget is significantly different from what is

available, and may be dictated by organizational budgetary constraints. For

example, the budget available for advertising a particular financial service

might be determined based on a percentage of the total premium revenues

generated in the prior year. Clearly, an increase in the intensity of an

advertising campaign would require higher budget allocations and may call for

the abandoning of traditional budget-setting approaches for advertising. The

total budget that is required to execute an advertising campaign is a function

of the reach and frequency (and hence the gross rating points) necessary to

create consumer response and the cost of media used to secure this level of

exposure. The associated dollar figure, therefore, needs to have been estimated

prior to negotiations with higher levels of management, in order to ensure the

availability of sufficient funds for executing an effective advertising

campaign.

(3) Estimating the Return on Investment (ROI):

The next step

in the advertising process is to determine the return on investments associated

with the advertising campaign. Four items of information are needed in order to

conduct this estimation, one of which is an estimate of the lifetime value of

an acquired customer. The lifetime value of the customer is the total profit

that an acquired customer represents to the company. It is quantified as the

sum of the profits associated with the stream of transactions that the customer

will undertake with the company over the years. In addition, an estimate of the

total number of consumers who will be exposed to the advertising campaign is

required. An estimate of the percentage of reached consumers who will

eventually purchase the advertised financial product or service is also

required. Clearly, negative return on

investment estimates would make the advertising campaign and unlikely prospect

for further action.

(4) Developing the Contents of the Ad:

Once the

return on investment computation has shown favorable results, the next step in

the advertising process is to develop the contents of the ad, as reflected in

its execution style and informational content. In this step, the services of

advertising agencies that specialize in producing financial services ads are

required. These specialized agencies often also engage the support of legal

experts who can determine the compliance of advertising content with existing

regulations. Often, testing of ad content using small-scale samples, focus

groups, or test markets may be needed.

(5) Media Selection:

The next step

in the advertising process is to determine the media that will be used. In

general, financial services that are more complex and require the communication

of detailed information tend to rely on print forms of advertising.

Television

advertising, which capitalizes on multiple sensory inputs, tends to be the most

effective although often the most expensive. Once the media to be used for an

ad campaign has been determined by the ad agency, a media schedule needs to be

developed in order to achieve the original objectives of the ad campaign which

had been identified. There are specific media scheduling and campaign execution

strategies that are most effective in certain forms of financial services. For

example, an effective ad-scheduling tactic is to advertise in pulses with heavy

advertising in one month, reduced advertising the following month, and a return

to high advertising levels in the third month.

(6) Scheduling and Campaign Execution:

There are

specific media scheduling and campaign execution strategies that are most

effective in certain forms of financial services. For example, an effective

ad-scheduling tactic is to advertise in pulses with heavy advertising in one

month, reduced advertising the following month, and a return to high advertising

levels in the third month.

This tactic

tends to result in more sales and higher levels of consumer response than a

constant and steady level of ad spending.

(7) Measurement:

The final

step in the advertising process is to assess the impact of the ad campaign

through formal market research or examination of company records. It is

critical to measure and record sales levels and other advertising responses

following an ad campaign in order to determine the financial effects of the

invested advertising dollars.

Such measures

may help fine-tune the advertising strategy of the company and provide

estimates for optimizing future advertising campaigns. For direct advertising

campaigns, such measures are obtained through the tracking of consumer

inquiries following the ad campaign and the use of tracking numbers, which can

pinpoint the exact promotional material to which the consumers are reacting.

For ads delivered through mass media such as television, radio, and newspapers,

the tracking of consumer responses may be considerably more difficult and might

require examining aggregate changes in sales for the months following the ad

campaign, or the purchase of market research data from specialized research

firms.

You can subscribe by e-mail to receive news updates and breaking stories.

You can subscribe by e-mail to receive news updates and breaking stories.

0 comments for "Explain the different steps in advertising for bank or financial services institutions"

Leave a reply